As legislators and Congressional staff negotiate the parameters of what increasingly looks like a one-year extension of the FAST Act, the Trump Administration’s estimate of how much extra money the Highway Trust Fund will require to get through another year is unusually divergent from Congress’s estimate.

The revised Congressional Budget Office forecast, released last week, projects that an additional deposit of $6.4 billion would be the bare minimum needed to keep the Highway Account from following below a “prudent minimum” balance of $4.0 billion, and the Mass Transit Account from falling below its prudent minimum of $1.0 billion, before the end of the next fiscal year on September 30, 2021. (The month-end prudent minimum is necessary to keep from hitting a zero balance on a day-to-day basis while waiting for periodic transfers of tax receipts from the Treasury.)

However, a “technical assistance” document provided to Congress by the Department of Transportation dated September 4 says that by the Administration’s calculation (Treasury, DOT and the Office of Management and Budget), the Trust Fund needs almost three times that amount – $18.6 billion – to maintain the same prudent minimum balance for that period.

How could the two sets of estimates be that far apart?

CBO and OMB always have differences on the spending side – OMB tends to assume that programs will spend money as quickly and efficiently as the law allows, whereas CBO looks more at past real-world performance when making its estimates. But the discrepancy appears to be on the revenue side.

DOT says that its revenue assumptions for FY 2020 for the Trust Fund total $39.1 billion in receipts, which is not that far off from CBO’s new $39.8 billion estimate. But we are now eleven months into that fiscal year, so the two estimates should be close.

Looking ahead to fiscal 2021, CBO’s new forecast projects Trust Fund receipts of $40.3 billion, which is an 6.9 percent drop (-$3.0 billion) below their initial forecast earlier this year. But DOT says that its scenarios “assume FY 2021 revenue is 30% below FY 2021 President’s Budget projections for both the Highway Account and the Mass Transit Account.”

In the FY21 Budget, HTF receipts and interest for 2021 were projected to be $42.8 billion, so a 30 percent drop would take receipts down to $30.0 billion (-$12.8 billion).

A 30 percent drop is huge, and it implies that coronavirus lockdowns and travel restrictions will be worse, on average, in 2021 than they have been since the onset of COVID-related restrictions in March of this year.

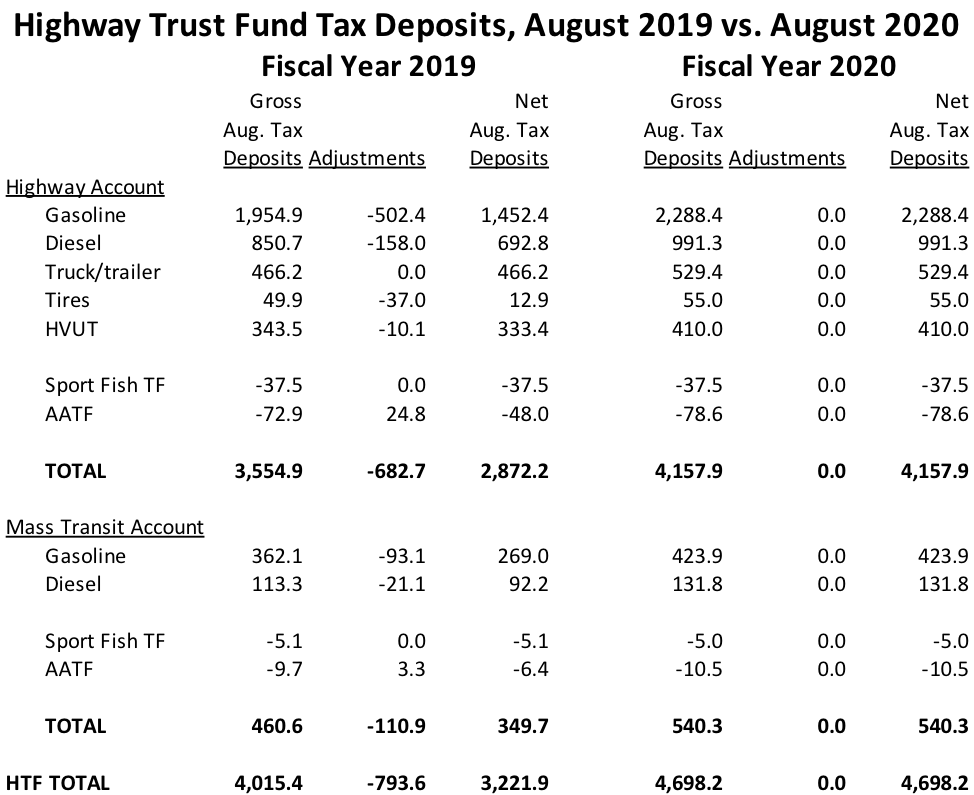

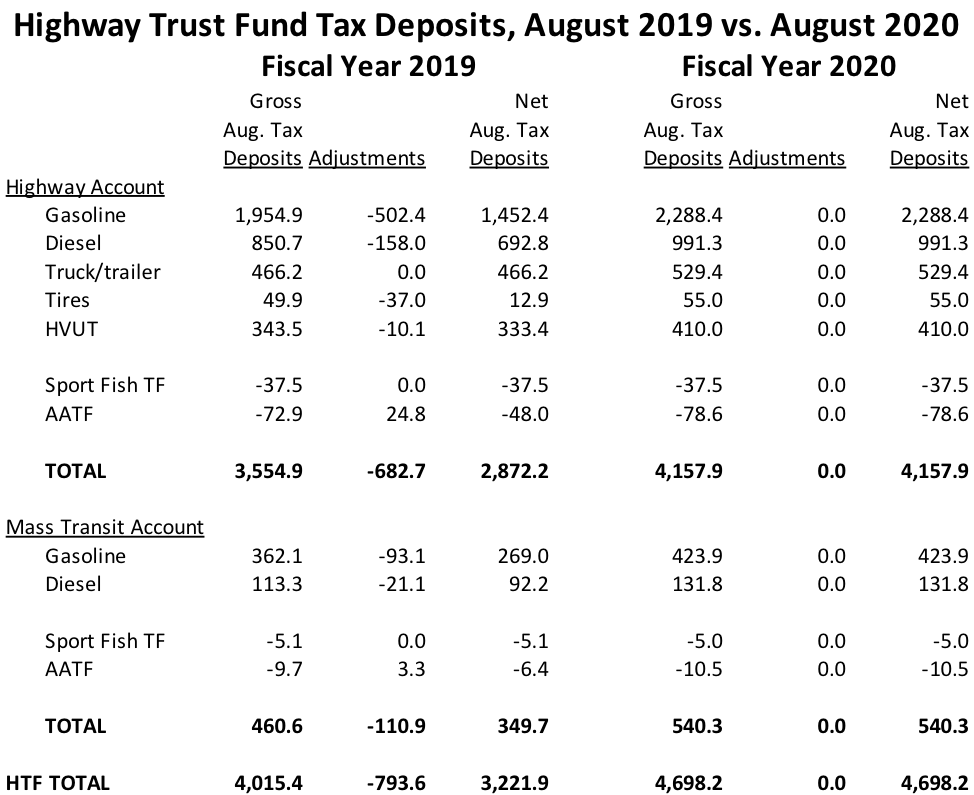

Just this week, the Treasury Department released the August actual Trust Fund revenue totals. And August was a very good month for the Trust Fund, with receipts of $4.7 billion, versus $3.2 billion for August 2019. This comparison is misleading, because August is supposed to be a month where Treasury adjusts quarterly estimated tax payments to account for actual tax filings, which happened in August 2019, but COVID-related filing delays mean that August 2020 had no adjustments.

For an apples-apples comparison, the pre-adjustment total receipts for August 2019 were $4.0 billion, so August 2020 is still about $700 million to the good.

On the year (fiscal year – since October 1, 2019), Trust Fund receipts are down $2.55 billion from fiscal 2019 actual levels, with one more month to go. (September always has a big reckoning/adjustment.)

But the fiscal year was about five months old when coronavirus started to hit, so we isolated the March-August receipt totals for 2020 versus 2019.

| Period |

HTF Tax Receipts |

| March-August 2019 |

$21,157.0 million |

| March-August 2020 |

$17,623.9 million |

| Difference |

-$3,553.2 million |

|

-16.7 percent |

The Administration is assuming that the COVID-and-recession impact on gasoline, highway diesel, truck/trailer, and tire sales, and heavy vehicle use, will be almost twice as bad in 2021 as it has been since the onset of coronavirus. (Ed. Note: The Administration must be using some serious doomsday scenarios here. Not zombie apocalypse level stuff, but pretty dismal nonetheless.)

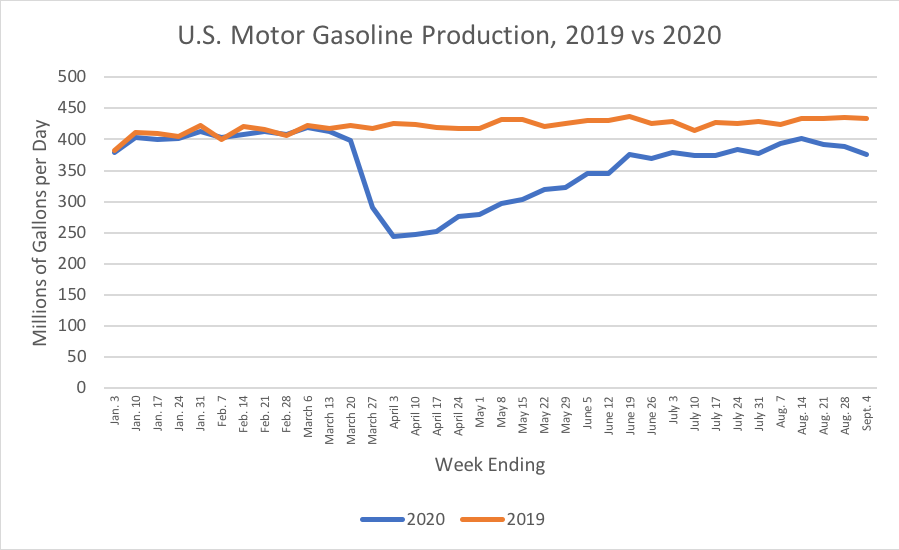

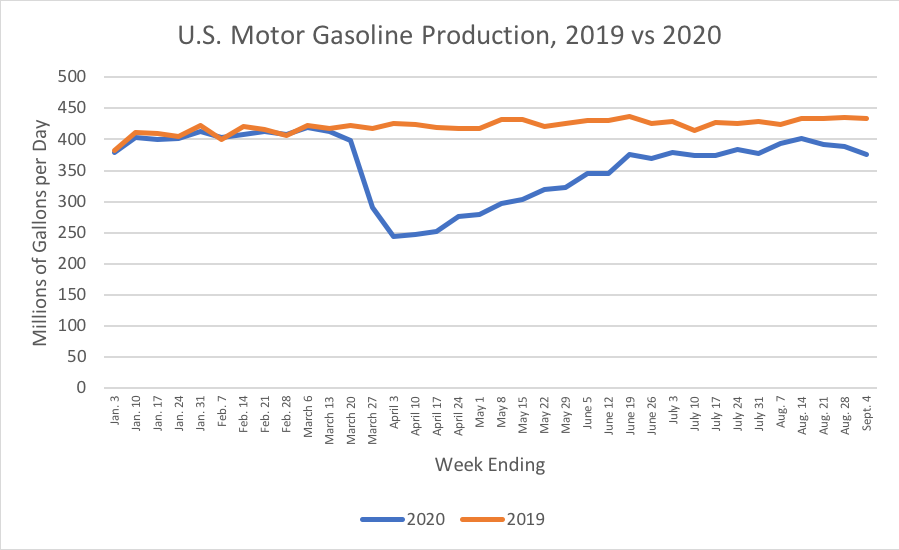

Using gasoline production as an imperfect proxy for both travel and Trust Fund receipts, we see that things went south rapidly starting the week ending March 6 and bottomed out in the last week of March and the first two weeks of April at around 40 percent below 2019 production levels. After a slow climb back, production stabilized in mid-June and has oscillated since then at between 7 and 14 percent below 2019 levels.

The Administration’s assumption of a year-long average of Trust Fund receipts being 30 percent below initial projections would mean, moving forward, that you would need to pull the blue line in the above chart down somewhere below the 300 million gallon per day level in October and keep it there for a full year. (It won’t track exactly, because there are delays in production and more delays in tax filing and diesel is more inelastic and truck sales are volatile, but that would indeed be the ballpark, on average.)