January 19, 2018

[The following is the text of a statement I submitted for the record of the House Rules Committee’s January 18, 2018 hearing on possibly bringing back Congressional earmarks.]

Submitted statement of Jeff Davis, Senior Fellow, Eno Center for Transportation

Hearing on Article I Oversight and the Power of the Purse

House Committee on Rules – January 18, 2018

I am Jeff Davis, Senior Fellow at the Eno Center for Transportation, a non-partisan think tank that has studied transportation policy since 1921. Before joining Eno, I published a newsletter from 2001-2014 called Transportation Weekly that analyzed federal transportation legislation. In 2002, I wrote a brief history of highway earmarking for my newsletter, and followed up in 2006 with the most detailed study to date of the earmarking process behind the 2005 SAFETEA-LU surface transportation law.

There is nothing inherently wrong with Congress using its power of the purse to direct funding to a specific project in a specific place. But starting in the 1990s, the spread of desktop computing with easy-to-use databases and spreadsheets made extensive earmarking so easy that Congress lost the ability to restrain itself. Excessive earmarking (and scandals connected thereto) caused a backlash that led both chambers of Congress to established self-imposed bans on earmarks beginning in 2011.

If Congress decides to bring back the practice of earmarking, there are certain additional reforms that could be considered to improve the process.

Require disclosure of real estate interests. Recently, there has been a proposal within Congress to bring back earmarks, but only if the earmarked funding goes directly to a state or local government. The thinking seems to be that by keeping earmarking a government-to-government enterprise, then much of the appearance of corruption that tainted the old earmarking process can be avoided.

This may be true for procurement and service earmarks, but where physical infrastructure is concerned, the primary potential for corruption has always come from the owners or developers of real estate that would see its value increased tremendously by the addition of infrastructure. It doesn’t really matter whether the infrastructure project itself is built by state or local government or by a private entity using federal money – as long as the infrastructure causes the value of the real estate to skyrocket, the potential for corruption from those real estate interests exists.

Additional public disclosure of the ownership of real estate that would benefit from earmarks would provide a valuable check on the potential for corruption. In addition, in other legislation, Congress could also consider mandating the use of “value capture” where possible. Value capture is a term for a series of methods through which the increase in real estate value caused by an infrastructure project is used to help pay for that project.

Separate planning earmarks from construction earmarks. The Corps of Engineers has a separate “Investigations” budget account that pays for the planning, environmental review, and design of potential projects, and a much larger “Construction” account that pays for building the projects that have successfully completed their planning, environmental review, and design phases. Earmarks in other fields of infrastructure too often simply assign a slug of money to a particular project, whether or not it has passed through the planning and design phases, which greatly increases the chance that the money will never be spent.

(Personal aside: I started my career working for a member of the Rules Committee, Jimmy Quillen (R-TN), and I remember how pleased we were to secure an earmark of $11.2 million in the 1991 ISTEA law for a new segment of the Foothills Parkway at the base of the Great Smoky Mountains National Park. $2.4 million of the money was spent on an environmental impact statement that determined the entire project would cost $115 million. No further funding was forthcoming, and to my knowledge, the remainder of the $11.2 million still sits, unused, on the books of the National Park Service to this day, 26 years later.)

Avoid de minimis earmarks. Nothing is more useless than a $1 million federal earmark for a $20 million highway project that the state doesn’t want to build. In the TEA21 and SAFETEA-LU earmark processes, rank-and-file members were given allocations of highway earmark money by the transportation committees and allowed to allocate it amongst projects in their districts or states as they saw fit. Too many of those members tried to divide their allocations to make as many different areas of their district or state happy and wound providing enough money to get a good press release but not enough money to actually get a project built.

Clarify earmark “ownership.” Within the committees of Congress, earmarks were considered to be the political property of the member who requested and received the earmark initially. Beyond that, those earmarks came out of House or Senate allocations and then within Republican or Democratic sub-allocations and were also considered to remain the property of the chamber and the party caucus.

In the past, the members who initially requested and received an earmark were allowed by the committees to move that money elsewhere in subsequent legislation if the first project did not work out for some reason. But if that original member left Congress, the money sat in limbo, with no one able to say to whom the money belonged (particularly if the control of a House of Congress had changed, or if Congressional redistricting had happened in the interim). This issue also dovetails with the fact that the concept-planning-construction-completion timeline of many infrastructure projects now exceeds the average tenure of a member of Congress.

Expand transparency requirements. In response to negative public attention to earmarks, both chambers of Congress adopted earmark transparency rules in 2007 requiring all earmarks to be identified by requesting member. At the same time, many of the committees of Congress began making public the information submitted by earmark requesters relating to the project. All of this increased disclosure was welcome (though, as mentioned above, public disclosure of the ownership of the real estate which would see greatly enhanced value from an earmarked project would be welcome).

More could also be done to ensure that earmarks are not added or otherwise transformed outside the more transparent committee process. Case in point: the Rules Committee. In 2005, the earmark that became the controversial “Bridge to Nowhere” (the Gravina-Ketchikan Bridge in Alaska) was funded in the version of the bill (H.R. 3, 109th Congress) as reported from the T&I Committee – but only at $3 million. As the bill was moving to the House Floor, the Rules Committee made in order a Young (R-AK) manager’s amendment in House Report 109-15 increasing funding for the Bridge to Nowhere from $3 million to $125 million. The amendment also added 316 new earmarks and amended scores of others.

Being a Rules Committee amendment, the text was only made public late in the evening on March 9 and then was adopted by the House early on March 10. While clause 9(a)(3) of rule XXI appears to apply the member disclosure requirements to manager’s amendments made in order by Rules, there is no requirement that the Rules Committee make public the questionnaires and other documentation that legislative committees made available pertaining to the specifics of each earmark. Also, clause 9(b) of rule XXI, which applies the earmark transparency rule to conference reports, did not anticipate that appropriations bills would be finalized outside of the formal conference process, which has (sadly) now become the norm. The rule should be expanded to cover amendments between the Houses as well.

Close loopholes in the definition of an earmark. Clause 9(3) of rule XXI defines an earmark as a provision that provides, authorizes or recommends a specific amount of budget, credit or spending authority, targeted to a specific place. This leaves a few loopholes where Congress can provide the equivalent of cash to a specific place without triggering the disclosure rule. Examples include:

- Different local match percentage. If an underlying statute requires a specific non-federal share of a project cost – 50 percent, 20 percent, whatever – and federal legislation then provides a lower non-federal share, or a 100 percent federal share, for a specific project under that program, that is functionally the same thing as appropriating additional federal money for that project. Yet it would probably not trigger the rule XXI disclosure requirements.

- Local match credits. Section 3043(h) of the 2005 SAFETEA-LU law provided that the Federal Transit Administration calculate the non-federal share of the net cost of a mass transit project in Harris County, Texas as including $324 million that the county had already spent on a different project. Functionally, this was little different than appropriating $324 million in federal money towards the new project, but it is doubtful if the provision would have triggered the rule XXI disclosure requirement had it been in place at the time.

- Targeting without mentioning location. The rule XXI definition of an earmark requires that money be “targeted to a specific State, locality or Congressional district, other than through a statutory or administrative formula-driven or competitive award process.” Congress, on occasion, makes specific entities eligible for funding based on criteria that, in theory, could be open to anyone but which, in practice, are limited to a single recipient. For example: section 119D of the FY 2017 Transportation Appropriations Act makes an unnamed airport which had fewer than 10,000 passenger boardings in 2017 but more than 10,000 boardings in 2012 eligible for federal airport grants it would otherwise not qualify for. This apparently did not violate the earmark ban.

Exercise restraint. In the House T&I markup of the bill that became the 1998 TEA21 law, chairman Bud Shuster famously pronounced that “angels in heaven” do not make project allocation decisions, politicians do – whether at the Congressional, federal executive, state, or local level. Accordingly, he said, since Congress had to provide all the revenue for the highway program, he was going to set aside 5 percent of total highway funding in the bill for projects earmarked by Congress.

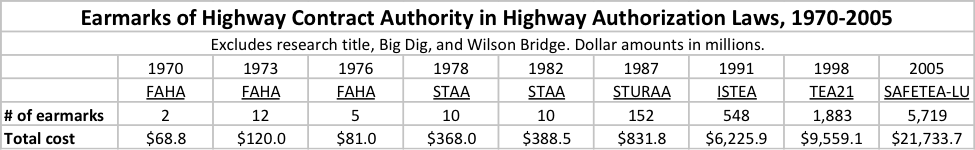

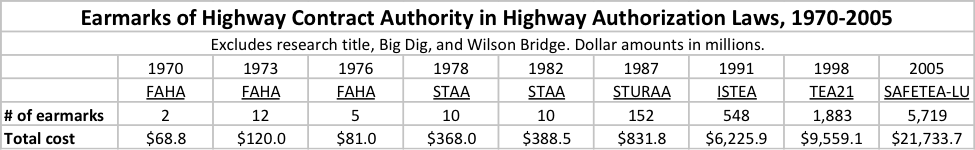

The earmarking of the highway bill had grown so much by 2005 that the SAFETEA-LU law earmarked at least 11 percent of the Federal Highway Administration’s entire five-year budget (and this excludes earmarks in the research title, which are harder to identify, and discretionary funds that were later earmarked by the Appropriations Committees). At some point, excessive earmarking can damage the ability of an agency to perform its underlying missions.

Restraint is also important on an individual level as well. The most that any House member received in high priority projects in the 1998 TEA21 law was T&I chairman Bud Shuster’s $111 million. In the 1998 SAFETEA-LU law, T&I chairman Don Young received $485 million in highway earmarks, and this was topped by Speaker Hastert’s $557 million and by Ways and Means chairman Bill Thomas’s astonishing $755 million. (See the attached January 17, 2006 issue of Transportation Weekly that I wrote for a more complete study of SAFETEA-LU’s earmarks.)

ENFORCE THE RULES. When the House first created a standing Committee on Roads, on June 2, 1913, the House also took care to add the following point of order to the rules of the House:

“it shall not be in order for any bill providing general legislation in relation to roads to contain any provision for any specific road, nor for any bill in relation to a specific road to embrace a provision in relation to any other specific road.”

During House debate on the resolution (H. Res. 104, 63rd Congress) the member who would become the first chairman of the Roads Committee (Dorsey Shackleford, D-MO) explained the intent of the provision:

“We have had an example before us of a pork-barrel bill in the shape of a public-building bill, and it was intended here to cut off any such legislation as that in relation to roads. It was intended that if a bill was brought in containing general provisions for the construction and maintenance of roads that Members would not be permitted to load it down with specific roads. We all know the vice of omnibus-bill legislation, and the purpose of these two exceptions to which the gentleman from Kansas has called attention is to make it impossible to have any logrolling or an omnibus bill.” (Cong. Rec., June 2, 1913, p. 1858.)

The intent of this provision seems fairly clear, and the point of order remained in House rules, unchanged but unused, throughout the growth of the highway earmark process through TEA21 and was finally repealed by the House in January 1999. It serves as a reminder that, in the end, no one can force Congress to obey its own rules.