January 22, 2018 (additions January 26)

On the morning of January 22, someone leaked an internal 6-page summary of the larger, 60-something-page White House infrastructure plan that has been formulated over the last year by the staff of the National Economic Council (NEC). Metadata for the PDF file of the document that went viral earlier today indicates that it was created from a Microsoft Word document on January 8. (The NEC staff have been careful not to allow electronic copies of any iterations of its proposal to be distributed during briefings so far.)

The document can be read here.

(Jan. 26 addition) White House infrastructure advisor D.J. Gribbin told a forum at the U.S. Conference of Mayors meeting this week that the White House’s forthcoming proposal will not contain any specific “pay-for” to offset the cost of the proposal. Instead, the direct funding for the plan will be fungible with the rest of the spending and revenue proposals in the President’s next budget.

The Administration had gotten some pushback from Capitol Hill Republicans during briefings on the full 60-some-page plan in recent weeks, asking them not to put so much detail out in public. The theory was that if the White House gave out too much detail on specific proposals, opponents of the plan would seize on the unpopular ones and use them to discredit the entire plan. Instead, they asked the White House for a much shorter summary of the plan, and the 6-page document leaked today appears to be it.

The White House would not comment on the document’s authenticity. (Jan. 26 addition: It now appears that the document was sent in late December by the Office of Management and Budget to affected federal agencies as part of the legislative clearance process and then leaked by someone at an agency.)

It’s worth noting that the plan summarized is the original version that maintains NEC chairman Gary Cohn’s commitment to the expansion of public-private partnerships (PPPs) as a means of financing key infrastructure projects, even though President Trump himself has repeatedly thrown cold water on the idea (including at the Camp David retreat with Congressional Republican leaders just before the January 8 date of the leaked document).

As previously reported in ETW, if the White House’s previous figure of $200 billion in new budget authority for the infrastructure plan holds up (and we should know that when the FY 2019 Budget is released on February 12), here is how the plan would spend that $200 billion:

| Program |

Percent… |

of $200B |

| I. Infrastructure Incentives Initiative |

50% |

$100B |

| II. Transformative Projects Program |

10% |

$20B |

| III. Rural Infrastructure Program |

25% |

$50B |

| IV. Federal Credit Programs (TIFIA/WIFIA/RRIF/RUS) |

7.05% |

$14.1B |

| VII. Federal Capital Financing Fund |

5% |

$10B |

| Unallocated |

2.95% |

$5.9B |

| TOTAL NEW BUDGET AUTHORITY |

100.00% |

$200.0B |

Some more details of the leaked 6-page document – which we believe to be an accurate distillation of the full 60-some page NEC plan – follows.

Title I. Infrastructure Incentives Initiative. Getting fully half of the federal funding ($100 billion of the total is $200 billion), this is program will provide up to 20 percent of the total project cost of a wide variety of types of infrastructure projects.

- The program is discretionary at the federal level, not formula-based. Project sponsors must apply and federal agencies would evaluate applications (see criteria below).

- Open to a wide variety of types of infrastructure: “surface transportation, airports, passenger rail, maritime and inland waterway ports, flood control, water supply, hydropower, water resources, drinking water facilities, storm water facilities, Brownfield and Superfund sites.”

- Key question #1 – how will the $100 billion be divided between federal agencies? How much for DOT vs Commerce vs EPA vs the Corps?

- Key question #2 – will there be any minimums or maximums for types of infrastructure?

- Maximum grant award of 20 percent of project cost, and no one state can get more than $10 billion of the $100 billion.

- Key question #3 – can the federal grant of up to 20 percent of project cost be combined with other federal funding (highway or transit formula money, TIFIA/RRIF loans, etc), and if so, are there any limits to that?

- Federal agencies are required to use the following criteria to evaluate projects:

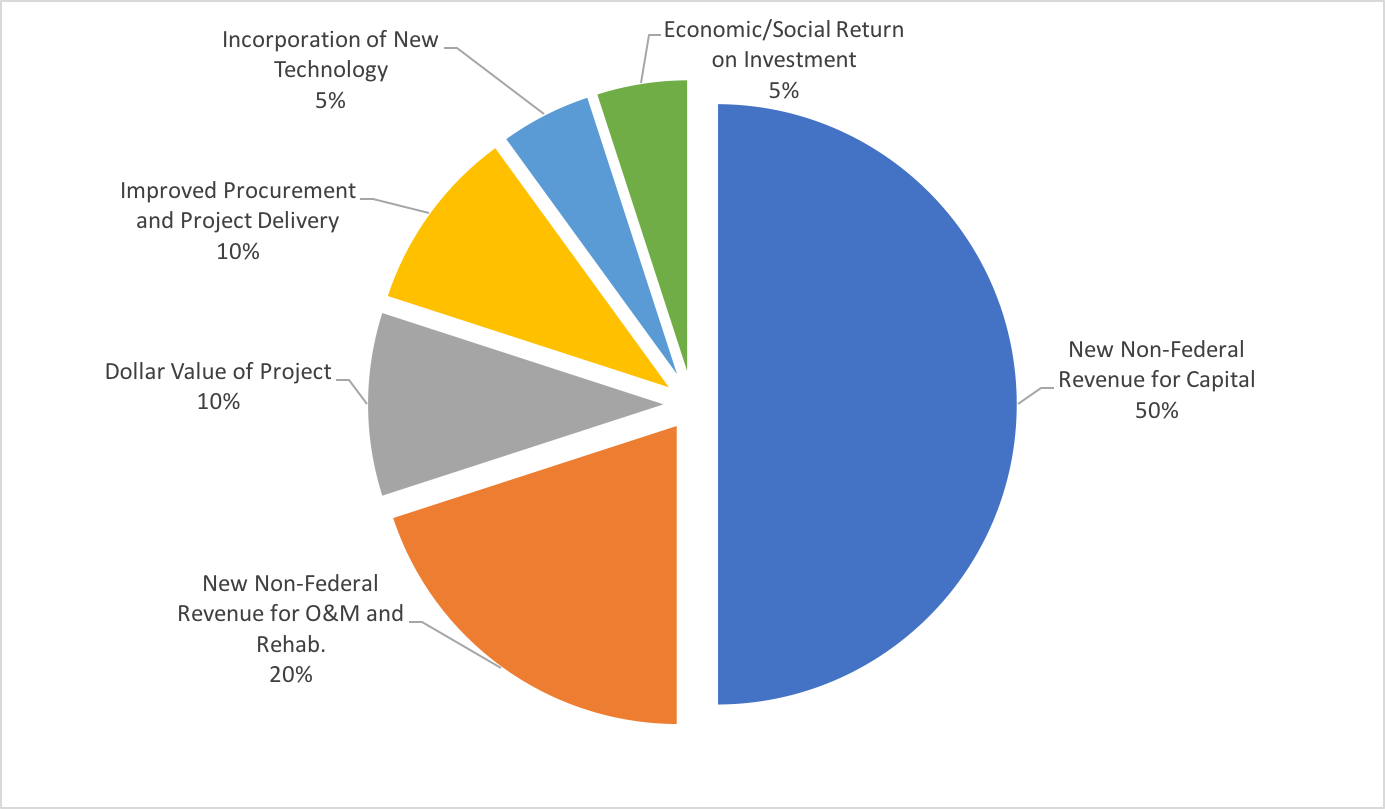

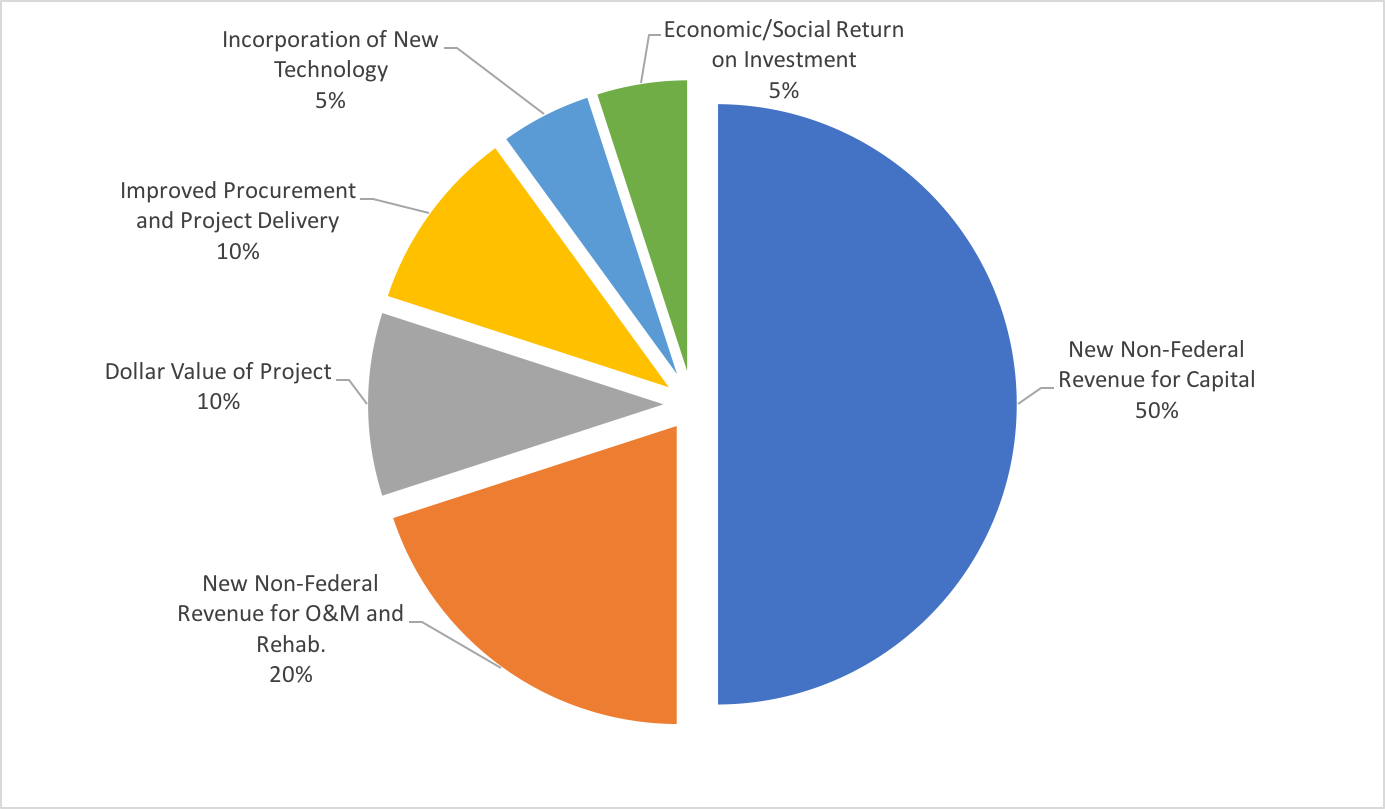

Weighting of Evaluation Criteria for $100 Billion Infrastructure Initiatives Incentive

Title II. Transformative Projects Program. Getting 10 percent of total funds ($20 billion), the Commerce Department (in cooperation with an interagency selection committee) would use this money to pick “innovative and transformative infrastructure projects based on competitive basis…viable projects unable to secure financing through private sector due to the uniqueness of the program. Applicable projects must be exploratory and ground-breaking ideas that have more risk than standard infrastructure projects but offer a larger reward profile. Covered sectors include: transportation, clean water, drinking water, energy, commercial space, and telecommunications.”

- A minimum (but not specified) minimum percentage of total project cost must be provided in the form of equity investments by private or non-profit organizations.

- Grants for the demonstration track (planning and R&D) would have a federal cost share of up to 30 percent.

- Grants for the planning track (final design an engineering) would have a federal cost share of up to 50 percent.

- Grants for the capital construction track would have a federal cost share of up to 80 percent.

- For capital construction grants, the federal government would retain the rights to share in financial value generated by the completed project.

III. Rural Infrastructure Program. This program would receive 25 percent of the total ($50 billion of $200) for infrastructure projects in rural areas across transportation, broadband, water, electric, and water resources classes. The program would have two components:

- Formula – 80 percent of the total ($40 billion out of a hypothetical $50 billion). Each state would receive an allocation based on the state’s share of total U.S. rural road lane-miles and based on the state’s share of total rural population. This formula money would be given to the Governor of that state for use in the rural areas of the state.

- Performance (discretionary) – 20 percent of the total ($10 billion out of a hypothetical $5o billion). States that publish a comprehensive rural investment plan within 180 days of receiving their formula money could then apply for discretionary grants.

- Key question #1 – how much of the money will be given out via the lane-miles formula versus the population formula, and will the different formulas have different program eligibilities?

- Key question #2 – what limits will be placed on a Governor’s discretion in how to allocate the state’s formula funds? Between types of infrastructure, between areas of the state, etc?

- Key question #3 – who will be running the discretionary grant portion of the program?

IV. Federal Credit Programs. The existing TIFIA, RRIF, WIFIA and RUS (Rural Utilities Service, USDA, responsible for rural electrification, broadband and telephone infrastructure loans) would get 7.05 percent of total funding ($14.1 billion of a presumed $200 billion). And since this money is for the “credit subsidy cost” of loans, it could conceivably at least ten times that much in the face value of federal loans and loan guarantees. Part of the document also suggests that the plan will expand the TIFIA program to include loans for airports, port, and inland waterways projects and will expand RRIF eligibility to short-line and passenger railroads.

V. Public Lands Infrastructure Fund. This would take funding for infrastructure on public lands largely out of the annual discretionary appropriations process by creating a new trust fund to hold federal revenues from mineral and energy leases on federal lands and waters, setting those revenues aside for public lands infrastructure.

VI. Disposition of Federal Real Property. “would establish through executive order the authority to allow for the disposal of Federal assets to improve the overall allocation of economic resources in infrastructure investment.”

VII. Federal Capital Financing Fund. This would use 5 percent of the total ($10 billion of $200 billion) as a one-time capital infusion for a new federal revolving fund that would allow the Appropriations Committees to finance large GSA real estate deals over 15 years instead of paying for any individual deal in one annual appropriation, which crowds out other spending.

VIII. Private Activity Bonds. The plan proposes various expansions of the use of private activity bonds (PABs), including the elimination of the transportation and state volume caps and expansion of eligible uses to more port and airport project. The plan also exempts PABs from AMT.

THE BIG UNANSWERED QUESTION – All of the percentages in the document only add up to 97.05 percent ($194.1 billion). Where is the missing $5.9 billion supposed to go? One possibility is that the expansion of PABs, and other non-transparent budget scoring of the plan, would cost a total of $5.9 billion on the 10-year PAYGO scorecard so is counted against the $200 billion total.

After the discussion of the portions of the plan that read like a summary of a draft bill, the 6-page document then continues a list of “Principles for Infrastructure Improvements” as shown below.

Principes for Infrastructure Improvements.

I. Transportation

A. Financing

- Allow states flexibility to toll on interstates and reinvest toll revenues in infrastructure

- Reconcile the grandfathered restrictions on use of highway toll revenues with current law

- Extend streamlined passenger facility charge process from non-hub airports to small hub sized airports

- Support airport and non-federal maritime and inland water way ports financing options through broadened TIFIA program eligibility

- Subsidize railroad rehabilitation and improvement financing for short-line and passenger rail

- Provide states flexibility to commercialize interstate rest areas

- Remove application of federal requirements for projects with de minimis Federal share

- Expand qualified credit assistance and other capabilities for state infrastructure banks

B. Highways

- Authorize federal land management agencies to use contracting methods available to states

- Raise the cost threshold for major project requirements to $1 billion

- Authorize utility relocation to take place prior to NEPA completion

- Refund of federal investment to eliminate perpetual application of federal requirements

- Provide small highway projects with relief from the same Federal requirements as major projects

C. Transit

- Require value capture financing as condition for receipt of transit funds for major capital projects (Capital Investment Grants)

- Eliminate constraints on use of public-private and public-public partnerships in transit

- Codify expedited project delivery for Capital Investment Grants pilot program

D. Rail

- Apply Fast Act streamlining provisions to rail projects and shorten the statute of limitations

E. Airports

- Create more efficient federal aviation administration oversight of non-aviation development activities at airports

- Reduce barriers to alternative project delivery for airports

- Clarify authority for incentive payments under the Airport Improvement program

- Move oversight of AIP funds to post-expenditure audits

II. Water Infrastructure

A. Financing

- Authorize Clean Water State Revolving Fund for privately owned public purpose treatment works

- Expand EPA’s WIFIA authorization to include flood mitigation, navigation and water supply

- Eliminate requirement under WIFIA for borrowers to be community water systems

- Authorize Brownfield rehabilitation and clean up of superfund sites under WIFIA

- Reduce rating agency opinions from two to one for all barrowers

- Provide EPA authority to waive the springing lien in certain lending situations

- Increase the base level of administrative funding authorized to ensure EPA has sufficient funding to operate the WIFIA program

- Remove the restriction on the ability to reimburse costs incurred prior to loan closing under WIFIA

- Expand the WIFIA program to authorize eligibility for credit assistance for water systems acquisitions and restructurings.

B. Water programs

- Remove the application of Federal requirements for de minimis Federal involvement

- Provide EPA infrastructure programs with “SEP-15” authorizing language

- Apply identical regulatory requirements to privately owned “public purpose” treatment works and publicly owned treatment works

C. Inland waterways

- Authorize all third party construction and operation arrangements as eligible expenses for inland waterways trust fund and treasury appropriations

- Authorize non-federal construction and operation of inland waterways projects

D. Water infrastructure resources

- Authorize user fee collection and retention by the Federal government and third parties under the WRDA Section 5014 pilot program

- Expend U.S. Army Corps of Engineers’ authority to engage in long-term contracts

- Authorize operation and maintenance activities at hydropower facilities

- Deauthorize certain federal civil works projects

- Expand authority for acceptance of contributed and advanced funds

- Retain recreation user fees for operation and maintenance of public facilities

- Amend the Water Resources Development Act to allow for waiver of cost limits

- Expand WIFIA authorization to include Federal deauthorized water resource projects

III. Veterans Affairs

A. Authorize VA to retain proceeds from sales of properties

B. Authorize VA to exchange existing facilities for construction of new facilities

C. Authorize pilot for VA to exchange land or facilities for lease of space

D. Increase threshold above which VA is required to obtain Congressional authorization for leases

IV. Land Revitalization (Brownfield/Superfund Reform)

A. Replicate the Brownfield Grant/Revolving Loan Fund program for Superfund projects

B. Clarify EPA’s ability to create special accounts for third party funds for CERCLA clean up response without state assurances

C. Provide liability relief for states and municipalities acquiring contaminated property through actions as sovereign governments

D. Provide EPA express settlement authority to enter into administrative agreements

E. Integrate clean up, infrastructure and long-term stewardship needs by creating flexibility in funding and execution requirements

F. Authorize national priority list sites to be eligible for Brownfield grants

G. Clarify risks to non-liable third parties that perform superfund cleanup.