(I meant to revisit this on August 1, on the 30th anniversary of the event, but the rollout of the bipartisan infrastructure bill bumped it. And now that the 30-year window is over and the records are unsealed, once COVID restrictions at the National Archives lift, a visit to the records of the Ways and Means Committee and the Public Works and Transportation Committee will be in order to finish the story.)

In the name of deficit reduction, Congress and President George H.W. Bush, in fall 1990, increased federal motor fuel taxes by 5 cents per gallon as part of a 5-year, $500 billion deficit reduction deal. Half of that 5 cent increase was deposited in the Highway Trust Fund in the final legislation, but the politics of the bill were entirely about raising taxes to reduce the deficit, and it led to a great schism in the Republican Party, with House Minority Whip Newt Gingrich (R-GA) leading an anti-tax revolt against a president of his own party which led to the House defeating the initial outline of the legislation.

1990 had been all about deficit reduction, but 1991 was scheduled to be all about transportation – the 1987 surface transportation bill was due to expire by September 30 and needed reauthorization. And 1991’s bill was expected to be particularly significant, as it would be the bill to answer the question of “now that the construction of the Interstate system is complete, what next?”

House Public Works and Transportation chairman Bob Roe (D-NJ) had a long list of ideas to answer that question, but they all required more money – more than the 11.5 cent per gallon fuels taxes devoted post-1990 to the Highway Trust Fund would provide. Roe thought that raising the HTF portion of the tax by 5 more cents, to 16.5 cents per gallon, should suffice. He called his plan a “Nickel for America” and spent the spring and summer of 1991 trying to drum up support for the proposal.

As early as April, there were warning signs that indicated that Roe’s move (backed by other members of his committee and House Speaker Thomas Foley (D-WA)) would face problems, with a spokesman for the Ways and Means Committee saying that “Until you can put something specific in front of [Congress], pairing with sweeteners like road and bridge repairs, it’s hard to predict,” and with a spokesman for the American Trucking Associations saying that “we gave at the office last year.”[i]

But by mid-July, the bill was drafted and the leadership had made a decision to make passage of the highway bill the big vote leading into the August recess, due to start by Saturday, August 3. On July 18, bipartisan leaders of the Public Works panel unveiled their bill, which would provide $140 billion in budget authority drawn on the Trust Fund over five years, with a sharp ramp-up (from $22.5 billion in FY 1992 to $32.1 billion in FY 1996). $6.8 billion of that five-year amount was for highway earmarks, up from $832 million in the highway bill covering FY 1987-1991, and the bill was predicated on Ways and Means later providing a 5 cent per gallon gas and diesel tax increase dedicated to the Trust Fund.

It is important to realize that for Roe, the drastically increased earmarking and the increase in gas tax were linked. In her book’s chapter on the ISTEA earmarks, Diana Evans wrote that:

[Roe] won the committee chairmanship partly on the basis of the leverage that such projects had given him in the past. By all accounts, the particular policy for which he most wished to use projects was the increase in the gas tax.

This time, several things were different from the cast in 1986 [the year the last highway bill was drafted]; chief among them was the committee’s active marketing of demonstration projects, compared to the more passive approach adopted by the committee on the earlier bill. In 1986, as a staffer noted, “The committee [didn’t] go out and say it’s having a sale of demos; you go to the committee; it says jump through these hoops, and you get it.” In the 102nd Congress, by contrast, the committee did have “a sale of demos:’ that year, another staffer said, the committee “put out the word” early in the process that it would be giving out demonstration projects. And early on, it was made very clear, very publicly, that the price of a project was support for the gas tax increase.[ii]

Public Works approved the bill on July 25, and on July 31 Ways and Means met to consider the tax increase. With a margin of 23 Democrats to just 13 Republicans on the panel, Rostenkowski should have been guaranteed a win on any issue he chose to press. But the vote to approve the 5 cent gas tax increase was just 19 to 17 – just one more vote switching from “yes” to “no” would have killed the proposal in a tie vote. Rostenkowski got 3 Republicans to vote with 16 Democrats in favor of the tax increase, while 7 Democrats and 10 Republicans voted no. A devastating article in Congressional Quarterly the following week pointed out the highway projects received by several of the Ways and Means members who supported the tax, and also pointed out that of the $6.8 billion in projects, $2.2 billion was going to the home states of just four House members – not coincidentally, the four leaders of Public Works (Roe, Shuster, Norm Mineta (D-CA) and John Paul Hammerschmidt (R-AR)).[iii]

The Republican “no” voters on Ways and Means said in their statement that “This 5 cent increase would result in a doubling of federal motor fuels taxes in the past 8 months and a 375 percent increase since 1981. Moreover, spending levels contemplated in the bill suggest that the 5 cent increase is just a down payment. In 1997, we may be looking at an additional 10 to 12 cent tax increase to continue the highway program authorized in H.R. 2950.”[iv]

And future Ways and Means acting chairman Sander Levin (D-MI) noted that the bill’s earmarks made it more difficult for him to support:

An important element of regenerating American economic growth is to reverse the deterioration in our nation’s infrastructure. Consistent with my vote last year, I can accept a second 5-cent increase in the gas tax, as proposed in the bill before the Ways and Means Committee, in order to undertake major improvements in our roads, bridges, and transit systems. However, as I have actively and vocally expressed to my colleagues, in Whip meetings and caucuses, it is vital that this bill be devoted to truly meritorious projects, and not those of a pork barrel type nature. I have been informed that this Committee does not have jurisdiction to amend the lists of projects in the bill or the subject matter beyond its tax provisions. But I will continue to press that the bill be changed to meet, and only to meet the critical infrastructural needs of the nation.[v]

The plan was for the bill to go before the House Rules Committee on Thursday, August 1, then go to the House for debate and passage on Friday, August 2, allowing members to fly home for the month-long recess and brag about how much the bill they just passed would improve transportation in their districts. Rules met as scheduled on August 1. Also on August 1, the White House issued a strong veto statement (after a series of lower-key but escalating veto statements over the preceding months) saying that President Bush would veto any highway bill containing a gas or diesel tax increase.

The Rules meeting bogged down in a technical dispute between Public Works and Ways and Means over whether or not the bill should be allowed to spend gross receipts from the gas tax that are then refunded back to farmers, airlines, governments, and other purchasers of fuel who are exempt from the tax (instead of the post-refund net receipts). But August 1 was also the day that House Democratic leaders were counting votes for the bill, and the combination of the tax increase, the earmarks, and the veto threat caused the count to come up short. The bill was pulled from the schedule, and House members went to recess empty-handed.

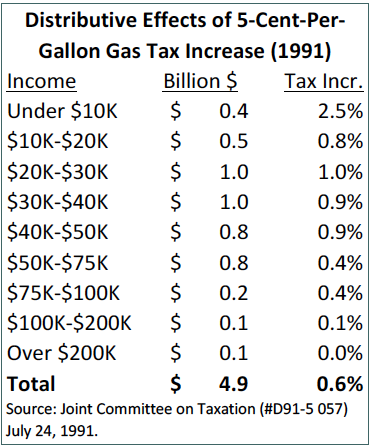

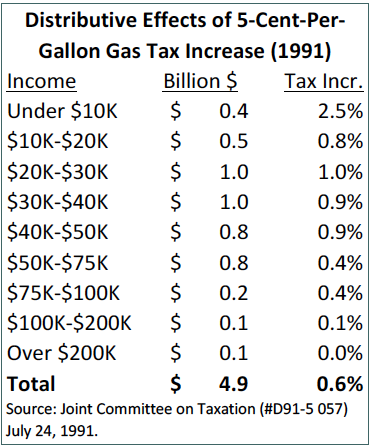

Evans summarized that “…many members were embarrassed by the well-publicized trade-off between demonstration projects and the tax increase, a combination that could be politically toxic, especially if the president chose to use it to justify a veto. As Ways and Means Democrat Byron Dorgan (N.D.) said, ‘Why would we want to be pushing for a relatively regressive tax that the president is insisting he would veto?’”[vi]

Evans summarized that “…many members were embarrassed by the well-publicized trade-off between demonstration projects and the tax increase, a combination that could be politically toxic, especially if the president chose to use it to justify a veto. As Ways and Means Democrat Byron Dorgan (N.D.) said, ‘Why would we want to be pushing for a relatively regressive tax that the president is insisting he would veto?’”[vi]

After the House returned from its recess, Democratic leaders decided to abandon plans to increase the gas tax on September 18.[vii] Roe unveiled a revised and downsized bill on October 10. But Public Works had become attached to the $150 billion total spending in the earlier bill (everybody loves nice round numbers), so Roe simply stretched $151 billion of spending over six fiscal years instead of five and downsized the earmarks somewhat. (This is how highway bills came to have a six-year duration – there is nothing magical about six years, it was just Bob Roe trying to make a bill that spent less money per year look equal in size to a shorter but higher-spending-per-year bill.) Public Works approved the stretched-out substitute bill on October 15 and Ways and Means approved a revenue title on October 16 that simply extended all gas taxes being deposited into the Trust Fund (including the 2.5 cents from the 1990 bill) through September 30, 1999. The House passed the revised bill easily, 343-83.

The Senate bill contained no revenue provisions (and the drive to increase the gas tax was not as strong in the Senate as it was in the House), so in the House-Senate conference, the negotiators simply adopted all of the House provisions, and the conference report was the last item to clear Congress before it adjourned for the year.

[i] Mike Mills, “Transportation: Push for 2nd Gasoline Tax Hike Gears Up in the House,” CQ Weekly Report, April 20, 1991, p. 974.

[ii] Diana Evans, Greasing the Wheels: Using Pork Barrel Projects to Build Majority Coalitions in Congress (Cambridge, Cambridge University Press, 2004) p. 117.

[iii] Mike Mills and David S. Cloud, “House Dispute Over Gas Tax Puts Highway Bill on Hold,” CQ Weekly Report, August 3, 1991 p. 2153.

[iv] Minority Views on H.R. 2950, contained in the report of the Ways and Means Committee to accompany that bill (House Report 102-171, Part 2) p. 26.

[v] Supplemental Views of Hon. Sander M. Levin, August 2, 1991, contained in the report of the Ways and Means Committee to accompany H.R. 2950 (House Report 102-171, Part 2) p. 25.

[vi] Evans p. 119.

[vii] Mike Mills, “House Leaders Withdraw On ‘Nickel For America’,” CQ Weekly Report, September 21, 1991 p. 2683.

Evans summarized that “…many members were embarrassed by the well-publicized trade-off between demonstration projects and the tax increase, a combination that could be politically toxic, especially if the president chose to use it to justify a veto. As Ways and Means Democrat Byron Dorgan (N.D.) said, ‘Why would we want to be pushing for a relatively regressive tax that the president is insisting he would veto?’”

Evans summarized that “…many members were embarrassed by the well-publicized trade-off between demonstration projects and the tax increase, a combination that could be politically toxic, especially if the president chose to use it to justify a veto. As Ways and Means Democrat Byron Dorgan (N.D.) said, ‘Why would we want to be pushing for a relatively regressive tax that the president is insisting he would veto?’”