November 16, 2016

Focusing on the “first 100 days” of a new Presidency is an artificial deadline. The real window for a productive first term of a new Administration is the first six to seven months – from Inauguration Day until whenever the House and Senate leave for their August recess. And much of that involves the new President’s first budget.

For most new Presidents, much of their entire first-term agenda is wrapped up in the first budget they submit to Congress and the first budget resolution ratified by Congress (to the degree that it reflects the President’s budget priorities). The Congressional budget resolution is the outline that sets the parameters for the spending and tax legislation that the committees of Congress can write for the remainder of the year. But equally importantly, the budget resolution opens the door for a filibuster-proof “budget reconciliation bill” that often contains the majority of the fiscal policy changes adopted during a new President’s first term.

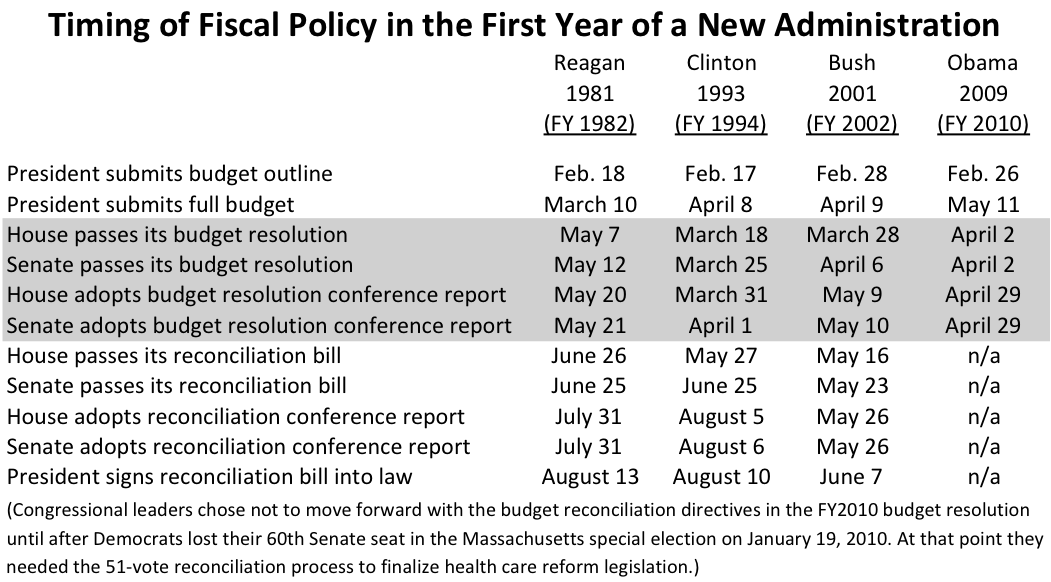

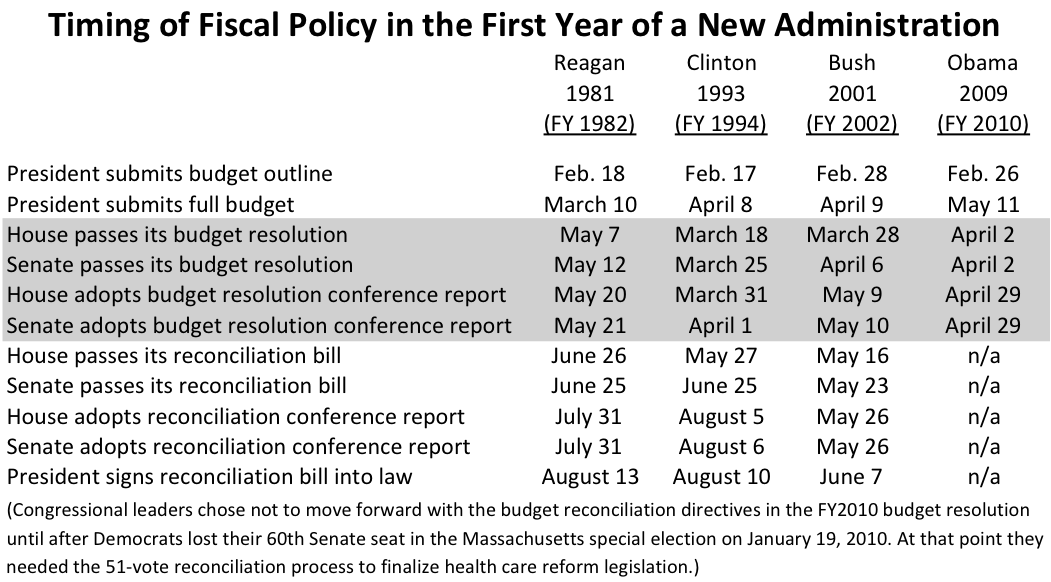

Timetable. In recent decades, new Presidents have submitted a broad outline of their proposed budget in mid-to-late February (100 to 200 pages in total). (For reference, here are links to the initial budget outlines submitted in their first weeks of office by Presidents Ronald Reagan, Bill Clinton, George W. Bush, and Barack Obama. Note the grandiose titles often attached to those documents.)

The full budget request and all its tens of thousands of pages of supporting documents then follow a few weeks or months later.

Both chambers of Congress then must pass a budget resolution – a blueprint, if you will. The budget resolution is all about “aggregates and allocations” – it declares what the annual totals of federal revenues and spending (by category) should be, and then it translates those aggregates into allocations of spending authority to each committee of Congress. The legislation produced by those committees for the remainder of the year must fit into those spending allocations.

(Ed. Note: The Congressional budget system established in 1974 does not work well for legislation that crosses lines between several committees. A process called “deficit neutral reserve funds” has evolved in the annual budget resolution – a reserve fund allows committees to trade revenue and spending allocations for a particular bill.)

All of the big-ticket items that President Trump wants to see enacted in his first year in office need to have their broad fiscal parameters accounted for in the FY 2018 budget outline that he submits to Congress in February, and the Congressional budget resolution must account for these initiatives in some way as well if they are to be enacted.

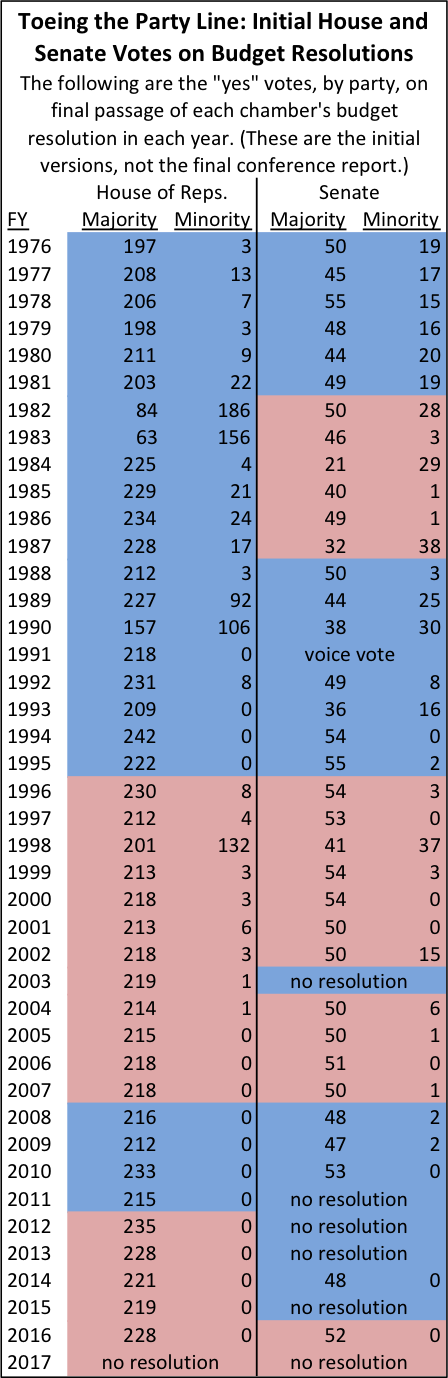

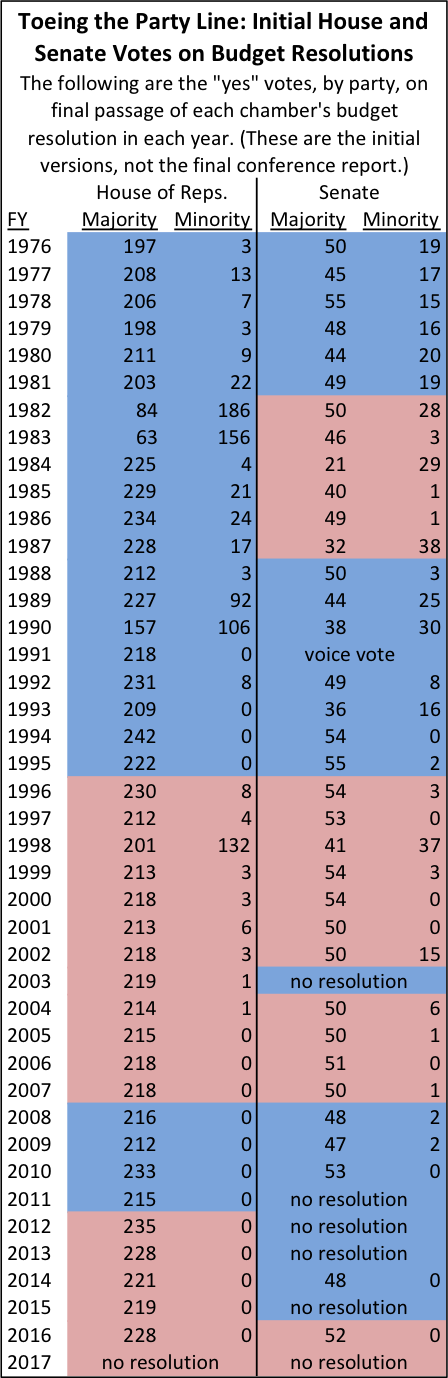

The process of drafting a Congressional budget resolution has become extremely partisan (no matter which party controls Congress). No member of the minority party in the House has voted in favor of a budget resolution for twelve years, and the situation is not much better in the Senate (where budget resolutions are exempt from filibuster and thus don’t have to reach a 60-vote threshold). As the table at right shows, with the exception of the two years (FY 1982-1983) when President Reagan had a working bipartisan majority in the House, and of fiscal years 1989, 1990 and 1998 when budget totals were set by bipartisan budget “summit” negotiations, the minority party usually forces the majority party to rely on its own votes to pass a budget plan.

(Speaking of partisanship, news broke today that since Congress did not bother to adopt a FY 2017 budget resolution this year, they may go ahead and adopt on quickly in late January or early February just to get a reconciliation bill to President Trump repealing parts of “Obamacare” in the first 100 days. But the meat of the agenda would still be in the 2018 budget from President Trump.)

One of the most important things that a budget resolution does is to give a lump sum total amount of spending authority to the House and Senate Appropriations Committees so that those panels can then subdivide the total amongst their subcommittees and start drafting the annual spending bills.

But this appropriations total now has to be consistent with the spending caps imposed by the Budget Control Act of 2011 (as amended). If the total amount of enacted appropriations exceeds the caps on defense and non-defense spending in a given year, another round of across-the-board sequestration cuts is automatically ordered by law to bring the totals down to the cap levels.

A Congressional budget resolution is an internal document that cannot amend the Budget Control Act’s spending caps. And the BCA caps are actually scheduled to shrink in fiscal 2018 versus their 2017 levels – defense will shrink by $2.1 billion and non-defense will shrink by $3.1 billion. Moreover, the defense cap levels are not compatible with President-elect Trump’s announced plans to expand the military.

|

FY 2017 |

FY 2018 |

| Defense |

551.1 |

549.0 |

| Non-Defense |

518.5 |

515.4 |

| Total |

1,069.6 |

1,064.4 |

Accordingly, some kind of law will have to be passed amending the BCA caps to make them compatible with whatever broad budget framework is decided upon by President Trump and the Republican Congress.

A likely vehicle for cap changes would be the next stage in the budget process – the budget “reconciliation” bill. This process was created by the 1974 Budget Act to reconcile the laws that control non-appropriated spending levels (and tax levels) with the budget aggregates and allocations in the Congressional budget resolution. The budget resolution instructs various Congressional committees to produce legislation increasing or lowering fiscal totals under their jurisdiction, and then the Budget Committees package all those submissions together in one giant bill.

Like the budget resolution itself, the reconciliation bill is statutorily exempt from Senate filibuster (and in a 52 to 48 Senate, the difference between needing 51 votes versus needing 60 votes is huge). However, separate rules govern reconciliation bills in the Senate. Under the Senate’s “Byrd rule,” each provision in a reconciliation bill must directly affect federal outlays or revenues (and those dollar changes must not be “merely incidental”), and those changes in revenues or outlays cannot extend beyond the “budget window” of the bill (which has been ten years of late).

(Ed. Note: This is why the Bush tax cuts enacted in 2001 expired ten years later and had to be extended in the “fiscal cliff” crisis – because they were enacted in a reconciliation bill.)

Any provision that violates the Byrd rule is automatically knocked out of the reconciliation bill unless at least 60 Senators vote to keep it in.

A budget reconciliation bill is the most logical vehicle for most of the changes in tax law envisioned by President-elect Trump and the Republican Congress, and to the extent that tax reform is used as a “pay-for” for infrastructure (or any other major agenda item), reconciliation is where it will probably end up. And the 1990, 1993 and 1997 budget reconciliation laws also provided for budget process reform (in the latter two instances the reconciliation laws were used to adjust the cap levels set in the 1990 law), making reconciliation the logical place for a cap increase as well.

A budget reconciliation bill could also contain many of the components of an infrastructure plan – any provision with a measurable and direct federal fiscal impact could be included. However, certain points of the Trump infrastructure plan involve things like permitting reform and changes to environmental rules that might violate the Byrd rule and be disallowed from a reconciliation bill.

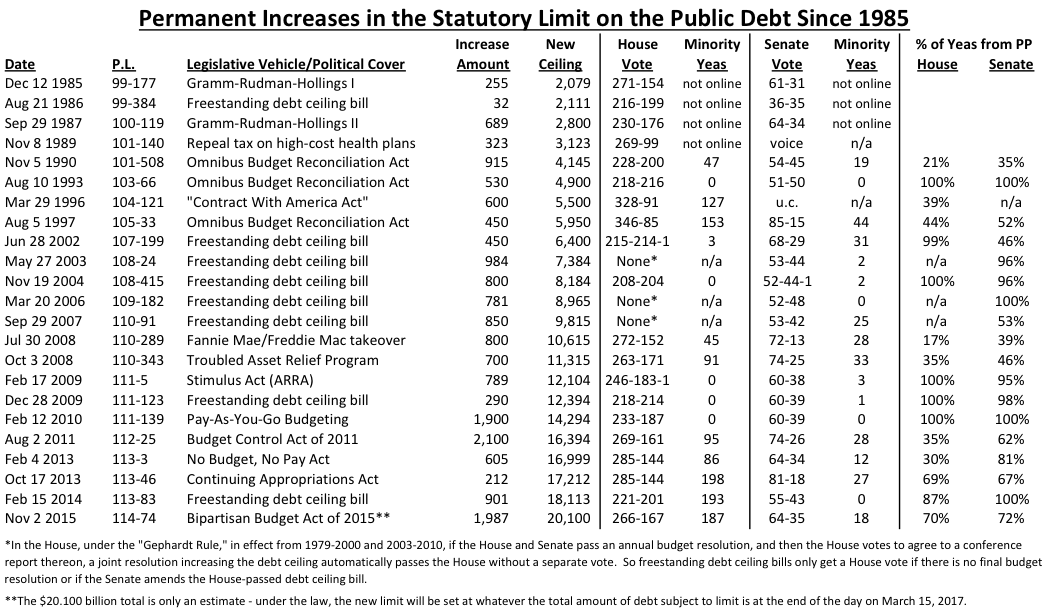

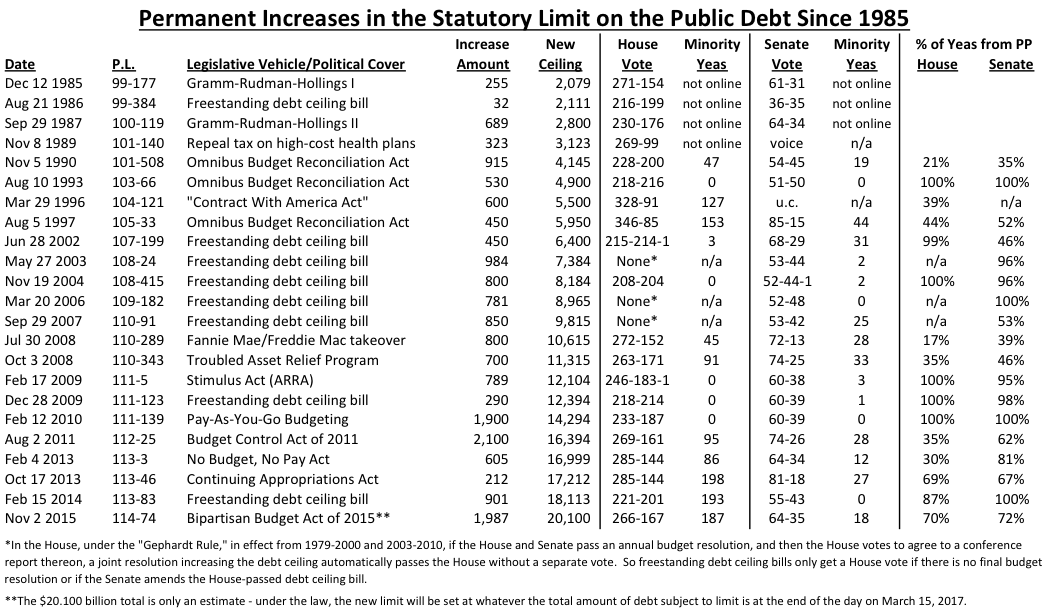

The other big must-pass fiscal issue for next year is an increase in the statutory ceiling on the public debt. The last debt limit increase (Public Law 114-74) did not set a new ceiling – it simply waived the old ceiling until the close of business on March 15, 2017. At that point, the new ceiling becomes whatever the debt total is on that day (the Bipartisan Policy Center recently estimated it will be $20.1 trillion).

At that point, the Treasury Department will begin to take “extraordinary measures” and start moving money around between federal pension funds in order to avoid breaching the new limit. These measures will run out before Labor Day, so some new debt limit law must be enacted before Congress adjourns for the August 2017 recess.

Raising the debt limit is always an extraordinarily difficult vote, and is usually packaged with some kind of political “sweetener” (see table below). The 1990, 1993 and 1997 budget reconciliation laws were used to carry debt limit increases (as was the Budget Control Act of 2011 and the Bipartisan Budget Act of 2015, both of which fulfilled many of the same functions as a reconciliation bill).

Infrastructure spending. Tax reform. Adjusting the annual caps on appropriations. Raising the debt limit. These are many of the major concerns of President-elect Trump’s first term, and they are all tied up to some extent in the outline of his first budget, which is probably less than four months away.