Tuesday, May 22, 2018

Twenty years ago today, on May 22, 1998, the House of Representatives and Senate passed the final conference report version of the landmark surface transportation reauthorization bill, the Transportation Equity Act for the 21st Century (TEA21).

Both the House and Senate passed the conference report on a Friday afternoon – the Friday before the annual week-long Memorial Day recess period – and it was the last vote of the week, which meant that members were so desperate to leave town that the debate, especially in the House, was cursory. The Senate agreed to the conference report by a vote of 88 to 5 and the House later agreed to the report by a vote of 297 to 86.

The legislation was the triumph of House Transportation and Infrastructure chairman Bud Shuster (R-PA, father of current T&I chairman Bill Shuster (also R-PA)), who negotiated the bill with Senate Environment and Public Works chairman John Chafee (R-RI).

Federal gasoline and diesel fuel taxes had been increased by 4.3 cents per gallon temporarily in 1993 as part of a five-year deficit reduction package. The 1997 tax bill extended that 4.3 cents of tax increase and transferred it to the Highway Trust Fund at the expiration of the five-year deficit deal, but the tax bill didn’t increase spending. The TEA21 law the following year increased Trust Fund spending levels in order to spend the increased tax revenues.

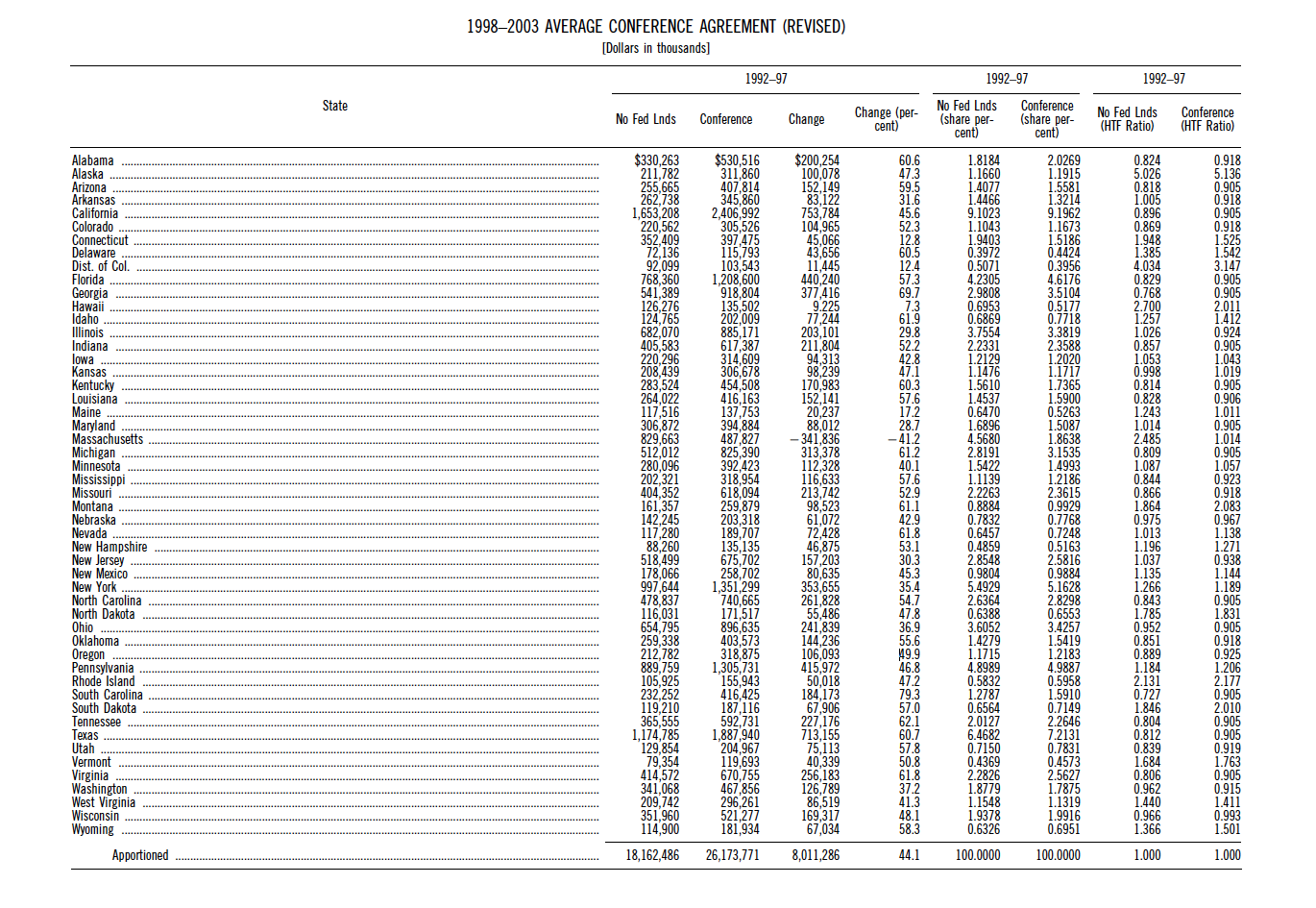

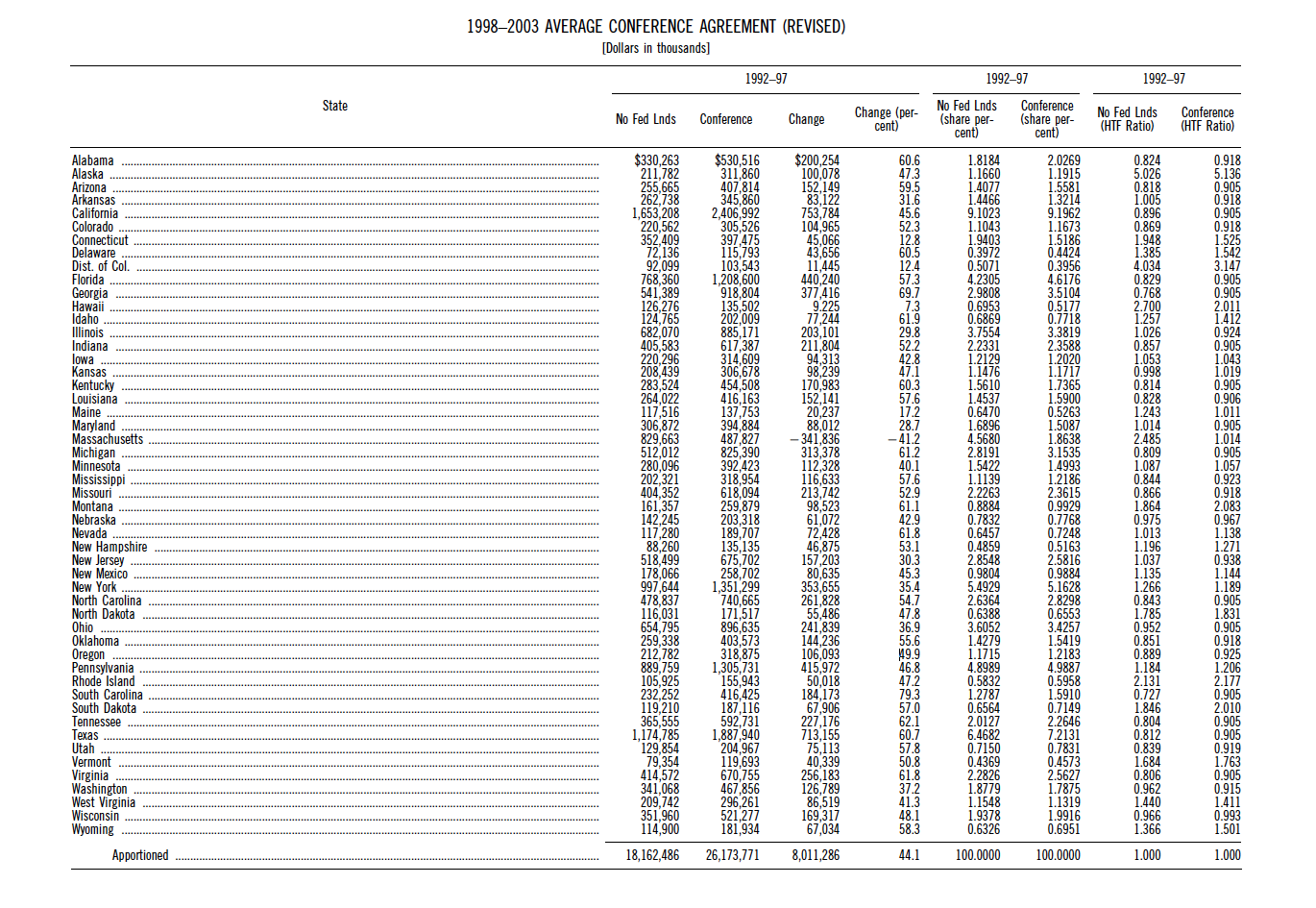

And a massive spending increase it was. In terms of highway formula money apportioned to states, the average over fiscal 1992-1997 (under the ISTEA law) had been $18.2 billion per year. But under TEA21, the annual average was projected to be $26.2 billion, an increase of 44 percent. Every state would see an increase (except Massachusetts, because the one-time expense of digging the “Big Dig” had been built into their formula money under ISTEA, leading to an inevitable rebound once the Dig was finished).

As legislators waited for the paperwork to be ready, the Senate floor debate (reprinted here on pages S5391 through S4317) started off rowdy. At the beginning, Appropriations chairman Ted Stevens (R-AK) insisted that he wanted to see how the bill affected his committee (and how it treated his home state) before he would allow it to come up for consideration: “I have not waited almost 30 years to be the chairman of this committee to see it emasculated in 5 minutes because people have to get a plane home.” (On the subject of how much money each state would get, Stevens complained that he had not seen any numbers yet. Majority Leader Trent Lott (R-MS) jokingly said “I would like you to meet Senator Chafee” to which Stevens responded, “I met him at Harvard Law School in 1947.”)

Although Senate rules were supposed to prohibit consideration of the conference report until after the House had passed it and sent the official paperwork over to the other chamber, Lott eventually obtained the unanimous consent of the Senate to pass bring up the conference report before the paperwork had actually been finalized. The Senate vote was over by 3:45 p.m. and Senators were gone.

The paperwork of the conference report was finally completed and filed in the House at 2:45 p.m. At 3 p.m. President Clinton went to the Rose Garden and told reporters that he would sign the bill into law (see his remarks here). And at 3:30 p.m. the House Rules Committee met to issue an expedited procedure so the $218 billion piece of legislation could be fast-walked through the House.

The House floor debate (transcript here) was brief and perfunctory. Appropriations Committee ranking minority member Dave Obey (D-WI) led the opposition to the legislation, citing the huge number of earmarked projects in the bill, the high spending levels (which encroached on his committee’s jurisdiction), and the offsetting cuts to veterans programs.

(The Budget Committees insisted that spending above baseline projections be offset. Projected outlays from the bill were $17.5 billion above baseline, and as an offset, the bill also made a net $15.4 billion cut in veterans benefits (most of which was from denying non-service-related tobacco illnesses) and a $2.4 billion cut in the Social Services Block Grant).

As a result, the 86 “no” votes were a bipartisan mixture (56 Republicans, 30 Democrats) of appropriators, members of the Veterans Affairs Committee including its chairman, and deficit hawks.

The bill was signed into law by President Clinton on June 9 as Public Law 105-178. (See President Clinton’s remarks at the signing here and the formal signing statement here.) However, staffers were in such a rush to get the conference report done so Congress could leave for Memorial Day that a great deal of material that had been agreed to was left out of the conference report. That material, along with a host of corrections, was added by the “TEA21 Restoration Act” enacted on July 22 as title IX of an unrelated IRS reform bill (Public Law 105-202). The text of the TEA21 law as amended by the Restoration Act was printed as a T&I committee document that can be found here. (The USDOT summary of the legislation is here.)

The legacy of the TEA21 law is a significant boost in infrastructure funding – in addition to the average 44 percent boost in highway formula funding, the bill doubled the size of the mass transit new starts program ($800 million in FY 1998, rising to $1.64 billion in FY 2003 at the end of the law). The bill also provided for the replacement of the Woodrow Wilson Bridge between Virginia and Maryland. It created the TIFIA transportation finance program and the Job Access and Reverse Commute transit program. And the earmarks, while dwarfing anything that had come before, paled in comparison to the amount of earmarks in the next bill in 2005.

But in liberating the Highway Trust Fund from some of its budgetary constraints, TEA21 also provided the means of the Trust Fund’s eventual demise. Here were chairman Shuster’s comments on the subject, 20 years ago today:

What it means, if we do spend the revenue going into the trust fund, and not a penny more, only the revenue going into the trust fund, means that this bill over six years can guarantee $200,500,000,000 spending, because that is the revenue projected to go into the trust fund.

Should there be more revenue going into the trust fund, that money will be available to be spent. Should there be less revenue going into the trust fund, then we will have to reduce the expenditures. It is fair, it is equitable, and it is keeping faith with the American people.

The key word in the first paragraph turned out to be “projected.” Because the mechanism for syncing trust fund Highway Account tax receipts with new highway spending levels (“RABA”) was based on estimated future receipts, not actual receipts, it allowed real money to be spent based on forecasting errors. And those forecasting errors proved to be substantial (see this Congressional Research Service report for the details).

(The revenue forecast in the TEA21 law itself, based on CBO numbers, was spot on – the law predicted $170 billion in Highway Account tax receipts over six years and the actual total was $171 billion. But the RABA calculation measured those against OMB’s updated predictions in each year’s budget submission, which were $3.5 billion too high in 2001 and $3.7 billion too high in 2002.)

After the forecasting errors came to light, it came time for the RABA mechanism to force massive cuts in new highway spending to correct the errors. While Shuster had promised that “Should there be less revenue going into the trust fund, then we will have to reduce the expenditures,” the same coalition of construction interests and state governments who had vigorously pushed the TEA21 spending increases refused to accept any cuts at all. (Shuster had retired from Congress by this point.)

Congress instead voted to keep the inflated highway spending levels based on the faulty revenue forecasts in the final year of TEA21 (FY 2003), which made them the baseline for the two years of TEA21 short-term extensions, and then Congress ratified the higher spending levels, plus increases, in the 2005 reauthorization law. Predictably, the Highway Trust Fund ran out of money in late 2008 and has required $144 billion in infusions from general revenues and other sources since then, all because Congress proved unwilling to fulfill the promise inherent in the TEA21 law of spending every dollar coming into the Trust Fund but “not a penny more.”